Compliance Corner [September 2024]

Here is what is new in September

New Massachusetts Pay Transparency Law

Federal Enforcement Updates

Other Enforcement Lawsuits

OFCCP Modifying “Early Resolution Conciliation Agreement Program” (ERCA)

Are Your Older Employees Saving Enough for Retirement?

Pending Minimum Wage Update

EEOC Criticizes Tech Industry Diversity

Beneficial Ownership Information (BOI) Reports Due on or Before January 1, 2025

New Massachusetts Pay Transparency Law

Employers with 100 or more employees in Massachusetts will be subject to extensive new pay reporting requirements, starting February 1, 2025. This includes not only salary data in job postings but also – for employers with at least 100 employees in MA during a calendar year – a detailed annual report with the state that includes workforce demographic and pay data categorized by race, ethnicity, sex and job category. Unions, governmental units within the state and even school systems must file the report every 2 years. The state will accept employers’ EEO-1 forms in lieu of the state form. The salary range posting requirement will become effective July 31, 2025.

Federal Enforcement Updates

In the month of August, the Government brought the following actions:

DOL Wage & Hour:

Tennessee staffing firm sent children into manufacturing jobs: $122,000 fine.

Pennsylvania Mexican restaurant: $1.3 million in back wages, tips and damages

West Virginia State Office of Miners’ Health: $57,000 in unpaid overtime to inspectors

Tennessee assisted care facility required to pay employee $30,000 for firing him in retaliation for his inquiry about unpaid overtime.

Other FLSA: 25 different violations in 19 different states, mostly in the northeast and Midwest (including Tennessee entry above).

OSHA: 10 violations in 8 states, including 2 that caused fatalities.

H2-B Visa: Carnival operator in Michigan shortchanged 32 visa workers, fined $72,000 in back wages.

EEOC: 9 lawsuits brought in 9 different states; 17 different settlements in 14 different states for penalties ranging from $47,500 to $1.25 million.

Other Enforcement Lawsuits

A former female employee of Chuck E. Cheese in West Virginia is suing the company because she was sexually harassed by both an employee and then their manager. The worker was 17 years old when the harassment started; it lasted almost a year until she quit.

A similar lawsuit is in process against a Taco Bell franchisee for sexual harassment committed by a manager who was a convicted sex offender. No background check had been conducted.

A school in Dallas, TX, for barbers and hair stylists is being sued by EEOC for rejecting an applicant because she was pregnant, even though she had passed a preliminary skills test. They were worried about liability – and they found it.

In a similar case in Texas, a pub terminated a pregnant bartender because they thought that she would not be safe and that her pregnancy would be “too much of a liability.”

OFCCP Modifying “Early Resolution Conciliation Agreement Program” (ERCA)

The ERCA has been very successful for both OFCCP and contractors, so naturally OFCCP is “streamlining” it and shortening its span from five to three years. This period is followed by a “traditional” audit moratorium of two years, so the freedom from audit is effectively reduced from seven to five years in total. To help offset that reduction of “freedom,” OFCCP has modified the program as follows:

To participate in the program, a contractor previously had to admit to wrongdoing and agree to a settlement. Under the revised structure, if the original findings by OFCCP turn out not to be valid/accurate, the program can be abandoned with no penalty.

There is also more flexibility regarding any financial penalties, making it more of a bilateral/ negotiation process.

And finally, ERCA negotiations will be limited to 60 days. If no agreement or resolution is reached within that time, OFCCP will terminate the process and proceed as usual.

Are Your Older Employees Saving Enough for Retirement?

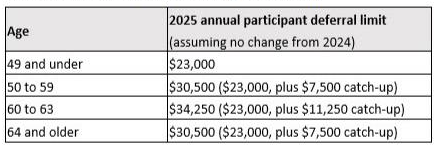

Starting in 2025, the SECURE 2.0 Act is raising the catch-up contribution allowances for older employees, as follows:

Defined contribution plans (excluding SIMPLE plans)

SIMPLE plans only

Pending Minimum Wage Update

The state of Florida will increase its minimum wage to $13.00 and the minimum wage for tipped workers to $9.98. Both increases will take place effective September 30.

EEOC Criticizes Tech Industry Diversity

According to a new EEOC report, the past 20 years have produced little increase in diversity in the tech industry. An agency report indicates that both minority and female representation saw very little change between 2005 and 2022, and workers over 40 have actually “lost ground in the last decade.” Another data point of interest is that discrimination claims regarding age, pay and genetic information are more common in the high-tech sector than in other industries. The foregoing data indicate a tendency toward discrimination in the overall sector, which will no doubt receive more attention from EEOC.

In that same vein, a separate survey of tech executives indicates that the sluggish economy has had a negative impact on DEI efforts. The survey, which polled 1,000 Gen Z workers and more than 300 senior tech executives, found that while 86% of business leaders think their DEI approaches are effective, nearly 60% still have trouble keeping talent from historically underrepresented groups. Among the Gen Z respondents, nearly 70% said they have felt uncomfortable at work because of their gender, race, ethnicity, socio-economic background, neurodevelopmental condition or disability — an increase of 20 points from the results of that same study conducted last year.

Reminder: Beneficial Ownership Information (BOI) Reports Due on or Before January 1, 2025

As VBS reported in a special notice at the end of last month, the Corporate Transparency Act (CTA) requires that companies formed or registered in the US on or before December 31, 2023 must file a BOI form no later than 1/1/2025. (Companies formed or registered on or after 1/1/2024 have already had to comply within 90 days of formation; new companies formed on or after 1/1/2025 have only 30 days after forming to comply.) Reports must be filed with the US Treasury Financial Crimes Enforcement Network (FinCEN). A “Beneficial Owner” is defined as one who owns or controls at least 25 percent of the “ownership interests” of a company OR who exercises “substantial control” (e.g., a Sr. VP). Penalties for failing to report can go up to $10,000 plus a prison term.

Exceptions: 23 types of companies are exempt from this reporting requirement. The most common types are these:

Public companies that are reporting issuers under the Securities Exchange Act of 1934 (Exchange Act) or are otherwise registered with the Securities and Exchange Commission (SEC) under the Exchange Act.

Large operating companies – which includes any company that employs more than 20 full-time employees in the US, has more than $5,000,000 in gross receipts or sales in the US, and has an operating presence at a physical office within the US.

501(c)(3) tax-exempt entities.

Certain highly regulated companies (such as banks and insurance companies).

Venture capital and private equity funds and their management companies (but portfolio companies and structuring vehicles below the funds would require separate analysis).

Subsidiaries of certain exempt entities, public companies and large operating companies, provided that the subsidiary’s ownership interests are entirely controlled, or wholly owned, directly or indirectly, by one or more eligible exempt entities.

Resources: E-filing instructions and informational links are available on the FinCEN website at https://boiefiling.fincen.gov/ and https://boiefiling.fincen.gov/help